Reimagining Start-ups with the Integration Studio Model

Why Start-ups Fail and Why It Matters

Start-ups are a risky endeavour with daunting odds. Around 20% collapse within their first year, 50% don’t survive past five, and in the venture-backed world, a staggering 90% fail to achieve long-term success (CB Insights, 2024). But why? The data reveals a clear picture:

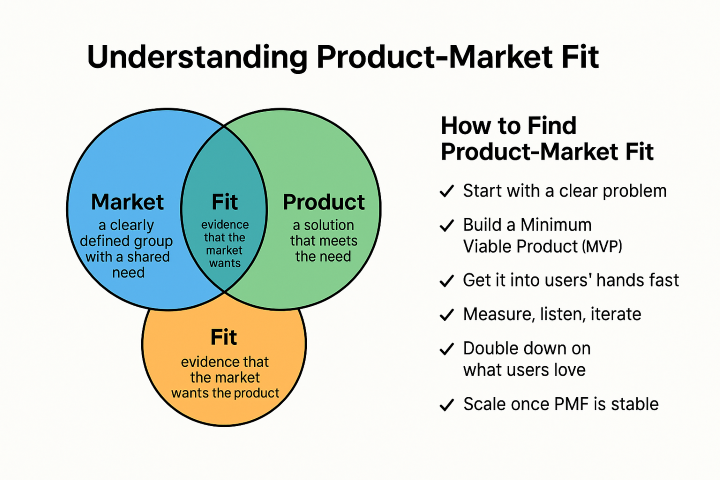

- No Market Need (42%): Many founders chase shiny tech without asking, “Does anyone want this?” Take Juicero, a start-up that raised $120 million for a $400 high-tech juicer. It flopped because consumers didn’t need a pricey gadget to squeeze juice; a classic case of a solution hunting for a problem.

- Poor Team Structure (23%): Even genius ideas need the right crew. Twitter’s early days were chaotic, with co-founder clashes forcing leadership shakeups that nearly sank the platform.

- Execution Gaps: Cash runs dry (29%), go-to-market plans fizzle (19%), or business models crumble. These missteps turn promising ventures into cautionary tales.

Failure matters because it’s not just a loss; it’s a signal. Behind every crash lies potential waiting to be salvaged.

The Residual Value of Failed Start-ups

Even when start-ups tank, they leave behind treasures that savvy players can repurpose. These “melting ice cubes” lose value fast, but they’re far from worthless:

- Intellectual Property (IP) and Patents: Unique ideas or tech that can block rivals or spark licensing deals. In 2022, IP from failed start-ups fuelled $1.2 billion in secondary market sales (PitchBook, 2023).

- Codebases and Tech: Software or algorithms ready for new uses. Google snagged Android for $50 million in 2005, a struggling mobile start-up, and turned it into the world’s top smartphone OS.

- User Data: Insights into customer behaviour that can sharpen future products. A busted e-commerce site’s analytics might guide a retail giant’s next move.

- Talented Teams: Skilled engineers and founders hungry for a second shot. Twitter’s acquisition of Vine’s crew bolstered its platform with top talent.

Google’s bets on Android and YouTube (bought for $1.65 billion in 2006 when it was bleeding cash) now generate billions. YouTube alone raked in $29.2 billion in ad revenue in 2022. These cases prove failure isn’t the end; it’s a pivot point.

The Integration Studio Model: A Game-Changer

The integration studio model transforms failure into a catalyst for innovation. Think of it as a master chef taking leftovers from failed restaurants and whipping up a Michelin-star dish. Here’s how it works:

- Snap Up Assets: The studio grabs IP, tech, and talent from failed start-ups at bargain prices, often 30–50% below peak valuations (PitchBook, 2023).

- Diagnose the Flop: A deep dive reveals the reasons for their failure, such as a lack of market fit. Weak execution? Team gaps?

- Build Dream Teams: Blend acquired talent with pros in marketing, UX, or ops to plug holes.

- Fuse Tech: Combine assets, like an AI algorithm from one start-up and a data platform from another, into a killer new product.

- Launch Smart: Roll out the venture with expert support and a laser focus on market needs.

Case Study: Turning Two Failures into One Win

In January 2024, two IoT-based companies caught our attention. One specialised in hardware, while the other focused on developing dashboards. Both had secured funding, but the dashboard company relied on a fractional investment model, where investors contributed funds monthly rather than in lump sums. When one investor defaulted, the company faced a severe cash shortfall.

Neither company launched its product nor generated revenue, even after 28 months of development. Combined, they consumed over ₹12 crore in funding but ultimately failed due to lack of market need and financial instability, forcing their closure.

Recognising the potential in their technologies, our team proposed consolidating the companies. After comprehensive due diligence, technical audits, and a thorough assessment of their teams and intellectual property, we acquired their technologies at a significantly reduced cost. We formed a new entity, retaining key talent from both start-ups and bolstering the team with our experienced marketing and operations professionals.

The outcome was a unified hardware-software solution designed to meet real market needs. We also provided ESOPs to the restructured team to ensure motivation and long-term commitment. We brought the reimagined venture to market within four months, and it turned revenue-positive within eight months, confirming the effectiveness of the integration studio approach.

ROI Perspective

This integration resulted in a revenue-generating venture within a year. Monthly revenue growth exceeded expectations within nine months of launch, and the return on investment surpassed 100% in the first year. Now, after 18 months, we anticipate a significant rise in profit margins due to the increased scale and operational efficiency.

Execution Blueprint: From Wreckage to Riches

- Sourcing: Identify distressed start-ups through networks, data platforms, and partnerships.

- Due Diligence: Deep analysis of market failure causes, tech viability, and cultural compatibility.

- Acquisition: Negotiate favourable terms for IP, codes, and acqui-hires.

- Rebuild Teams: Blend acquired talent with new specialists to overcome skill gaps.

- Integration: Merge technologies into a unified product or platform.

- Launch: Bring the refined product to market with full go-to-market support

We design each stage to mitigate risk and accelerate time-to-value.

Global Applicability

This model applies far beyond just tech start-ups. Though this article focuses on technology ventures, a similar integration studio approach can be applied across a wide range of industries. In fact, failing start-ups from different countries and sectors can be brought together into one global integration ecosystem using a special purpose vehicle (SPV). An SPV serves as a legal and financial structure that enables the combined ownership and management of assets, talent, and technology across borders.

This kind of setup makes it easier to acquire distressed assets, repurpose technologies, and relocate or retain top talent regardless of location. By streamlining international collaboration and simplifying asset transfer, the SPV approach helps reduce time to market and increases return on investment.

Emerging markets such as India, Southeast Asia, Latin America, and Africa are particularly well-suited to benefit from this model. Their vibrant but risk-prone start-up ecosystems present both the need and the opportunity for integration-driven innovation at scale.

Failure’s New Chapter

The integration studio model redefines failure as a source of raw material for innovation. By systematically acquiring and repurposing the valuable assets of failed start-ups’ IP, codebases, data, and talent, it rescues innovations that might otherwise be lost. Through structured due diligence, strategic integration, and rapid execution, the model turns wreckage into wealth.

Rather than betting on lone founders and untested ideas, this model invests in technology, talent, and traction. In a world where 90% of start-ups fail, the integration studio offers a scalable, global solution to build the next generation of ventures. It’s time to embrace failure not as an endpoint but as fuel for the future.

Content authored with the assistance of ChatGPT.com

#startups #venturecapital #innovation #turnaround #integrationstudio #founders #productstrategy #entrepreneurship