The landscape of startup fundraising has fundamentally shifted. For founders navigating the capital markets in 2025, the rules of engagement look markedly different from the exuberant days of 2021–2022. The era of “story-first, traction-later” fundraising has decisively ended, replaced by a more disciplined market where investors demand proof points and founders think strategically about dilution.

The New Normal Across Funding Stages

Pre-Seed: Stabilization at Reasonable Levels

The pre-seed market has found its footing. Most rounds in the $500K–$2M range are closing with post-money valuation caps between $8M and $20M, with founders typically diluting 7%–20% of their equity.

What’s notable here is the shift in behaviour. Even founding teams with strong pedigrees are no longer attempting to skip the pre-seed stage entirely. However, quality teams are being rewarded with healthier cap structures that set them up for sustainable future rounds rather than creating problematic valuation compression down the line.

Seed: The New Series A

Perhaps nowhere is the market evolution more apparent than at the seed stage, which has effectively bifurcated into two distinct patterns. SAFE rounds typically range from $2M–$4M with median caps around $15M, while priced seed rounds have grown substantially larger at $3M–$6M, commanding post-money valuations between $19M and $30M.

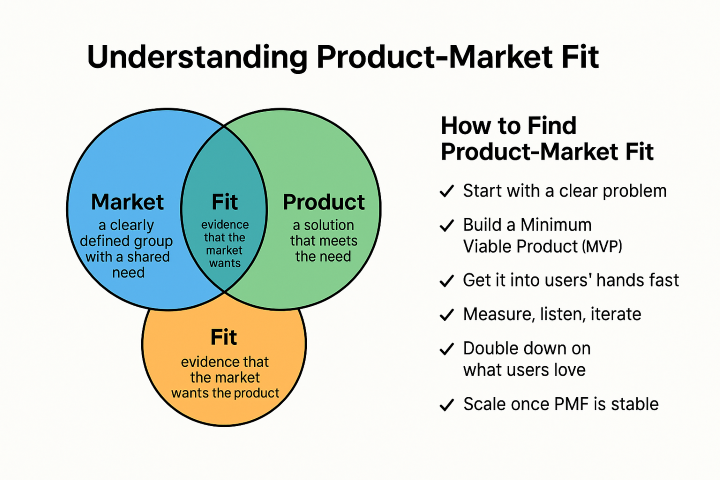

This transformation reflects a fundamental truth: seed is the new Series A. If you’ve built a minimum viable product with demonstrable traction, the market will support a substantial seed round. These are no longer bridge rounds designed simply to get you to the next milestone; they’re real capital raises that can fund meaningful growth.

Series A: Execution Over Vision

The median Series A round in 2025 involves raising approximately $11M at roughly $60M post-money valuation, resulting in about 18% dilution. But the numbers tell only part of the story.

What investors are scrutinising has changed. They’re looking for consistent revenue motion rather than one-off customer wins. They want evidence of scalable customer acquisition, not just heroic sales efforts. Most importantly, they need to see a clear path to Series B metrics before they’ll commit.

The shift is subtle but significant: vision still matters, but execution velocity matters more. Investors are funding proven playbooks, not unvalidated hypotheses.

Growth Rounds: Selective but Healthy

Series B and C rounds have returned to health, but access to these later stages has become more selective. Series B companies are raising a median of $25M at $153M post-money valuations, while Series C rounds typically involve $32M raises at $309M post-money.

To reach these stages, companies need more than just growth. Investors are looking for strong leadership teams, demonstrated market pull rather than manufactured demand, and efficiency discipline. Burn multiples, which were largely ignored during the boom years, matter again.

What Founders Should Do With This Information

These benchmarks serve several practical purposes. First, they help set realistic fundraising targets; understanding where the market actually is prevents wasted time pursuing unrealistic valuations. Second, they provide a framework for avoiding unnecessary over-dilution by showing what’s typical rather than exceptional. Third, they enable founders to negotiate from a position of informed confidence rather than guessing what terms should look like.

Perhaps most importantly, these benchmarks clarify what progress you need to demonstrate before attempting to move up a stage. Each funding tier now has relatively clear entry requirements.

It’s worth emphasising what the goal should not be: chasing the highest possible valuation. The goal is to raise what you need, at terms that position you to win long-term. A slightly lower valuation that allows you to hit milestones and raise your next round on schedule is far better than an inflated valuation that creates impossible expectations.

The Rational Market

The fundraising market in 2025 isn’t “hard” in the sense of being arbitrarily difficult or closed to good companies. Rather, it’s rational. Strong teams making meaningful progress continue to get funded. Those that aren’t there yet iterate, sharpen their approach, and return stronger.

This rationality, while perhaps less exciting than the free-flowing capital of previous years, is ultimately healthier for the startup ecosystem. It rewards substance over storytelling, execution over ambition alone, and sustainable growth over growth at any cost.

For founders, the message is clear: know your metrics, understand your stage, and raise accordingly. The market will reward those who meet it where it is, not where it used to be or where they wish it would be.

Visual created and the text crafted with support from .