In the high-stakes world of startups, securing funding is often the difference between soaring success and swift failure. Traditionally, investments arrive as lump sums: substantial capital injections to fuel growth, hire talent, and seize opportunities. But an unconventional approach has gained traction: receiving investments in monthly installments. At first glance, this might seem like a steady, manageable lifeline for a fledgling company. Yet, beneath the surface lie significant risks that could undermine a startup’s future. In this article, we’ll uncover the hidden dangers of this funding model and why founders should approach it with caution.

1. Cash Flow Challenges

Startups are unpredictable by nature. One month might demand a major marketing push, while the next requires new equipment or a key hire. Lump sum investments give founders the flexibility to tackle these expenses as they arise. Monthly installments, however, can create cash flow mismatches that leave startups strapped at critical moments.

Picture this: a startup spots a chance to buy inventory at a steep discount, but the deal requires immediate payment. If the next installment is weeks away, that opportunity slips through their fingers, potentially costing more in the long run. Early-stage companies often run on tight margins, and a single large expense (think legal fees or a tech upgrade) could wipe out a month’s funds, leaving no room for basic operations until the next payment. This feast-or-famine cycle breeds financial instability and hampers effective planning.

2. Administrative Burden

Running a startup is a juggling act, and managing finances is already a hefty ball to keep in the air. Monthly installments add extra weight. Each payment demands documentation, accounting updates, and sometimes legal oversight. This administrative overhead eats into time and resources better spent on building the business.

Imagine a founder hunched over spreadsheets, tracking installments and filing paperwork instead of refining their product or pitching to customers. That’s time lost to bureaucracy, not innovation. Plus, the costs add up, whether it’s hiring an accountant or investing in software to manage the complexity. For a startup scraping by, every dollar diverted to administration is not fuelling growth.

3. Reduced Flexibility

Agility is a startup’s superpower: the ability to pivot fast when markets shift or opportunities knock. Monthly installments, though, can chain a company to a rigid financial rhythm, stifling this essential flexibility.

Consider a competitor rolling out a game-changing feature. To keep pace, the startup needs to hire developers now, not next month when the next installment lands. With a lump sum, they could act instantly; with installments, they’re stuck waiting. Scaling up, whether through marketing, inventory, or infrastructure, often demands upfront capital too. Without it, startups risk missing their moment or settling for suboptimal decisions driven by cash constraints rather than strategic vision.

4. Dependency and Loss of Autonomy

A steady drip of monthly funds can feel reassuring, but it comes with strings. Relying on regular installments can foster dependency on the investor, subtly shifting the power dynamic. Founders might hesitate to make bold moves that could ruffle their benefactor’s feathers, even if those moves serve the company’s long-term good.

Worse, investors doling out monthly payments might expect more oversight: frequent updates, input on decisions, or even veto power. This blurs the line between investor and manager, eroding the entrepreneurial freedom startups thrive on. And if an investor delays or pulls an installment, say, over a disagreement or their own cash crunch, the startup could be left high and dry, unable to cover payroll or keep the lights on.

5. Psychological Effects

There’s a mental trap in monthly funding: the illusion of stability. Knowing cash is coming regularly can lull founders into complacency, dulling the urgency to hit milestones or tighten operations. In the breakneck startup world, that’s a dangerous mindset.

It can also breed sloppy financial habits. With a predictable trickle, founders might spend to the monthly limit without building a buffer for the unexpected: a key hire leaving, a market dip, or a broken server. One startup might burn through its installment on day-to-day costs, only to face a crisis with no reserves. This “pay cheque-to-pay cheque” cycle isn’t just unsustainable; it’s a ticking time bomb.

6. Impact on Future Funding

How you fund today shapes how you fund tomorrow. Monthly installments might raise eyebrows among future investors, who could see it as a sign the startup couldn’t secure a lump sum: a potential red flag on credibility or traction. This perception could drag down valuations or scare off new backers.

The terms tied to installments can also muddy the waters. If the initial investor retains special rights or preferences linked to the payment schedule, it might spook others who prefer a clean cap table. Startups need to stay attractive to a wide investor pool, and quirky funding setups can close doors instead of opening them.

7. Opportunity Cost

Time is a startup’s most precious currency, and monthly installments nickel-and-dime it away. Every hour spent managing payments, reconciling accounts, chasing updates, and negotiating terms is an hour not spent on product development, customer outreach, or team growth.

Founders should be laser-focused on what moves the needle, not distracted by funding admin. The slow bleed of these tasks can stall momentum, giving competitors an edge. A funding model that frees up mental bandwidth for innovation beats one that bogs you down in busywork every time.

A Real-World Example

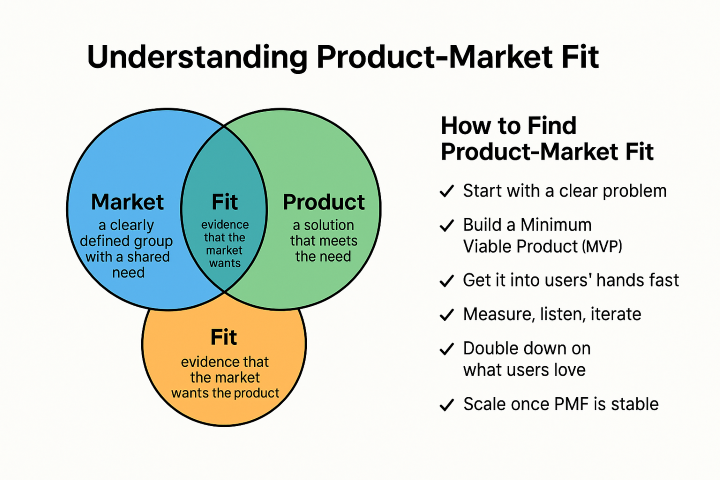

Consider a startup that chose this path in March 2024. They secured a commitment from two individual investors to fund the company in monthly installments of $10,000. The plan was to increase this to $15,000 per month after the MVP (Minimum Viable Product) was delivered by the end of September and to follow it with a balloon payment of $20,000 in November after successful testing. The startup maintained a lean burn rate of $8,000 per month, with $2,000 kept in reserve for expansion.

Working efficiently, the startup completed the MVP by August 2024, ahead of schedule. But that’s when the trouble began. One of the investors encountered financial difficulties and failed to contribute. The other investor covered only $5,000 in August. Fortunately, the $2,000 reserve helped them get through that month. But the situation repeated in the following months, making it impossible to properly test the product or enter production.

Despite positive feedback from demos and clear market interest, the lack of consistent funding stalled further development. Eventually, the second investor stopped contributing as well, citing the first investor’s non-payment. Worse, both investors went silent, ghosting the company altogether.

By January 2025, the startup had defaulted on rent, salaries, and vendor payments. When the investors reappeared in February, they promised to resume support at $15,000 per month. Only one payment was made over two months before the funding dried up again. Demoralised and underpaid, the remaining employees left. The startup was forced to shut down, and a promising product never made it to market.

This is the silent killer of monthly installment funding: not just the lack of capital, but the erosion of morale, trust, and momentum.

Conclusion

The promise of steady monthly cash might tempt cash-strapped founders, but the downsides can outweigh the perks. Cash flow headaches, administrative drag, and lost flexibility are just the start. Add dependency risks, psychological pitfalls, and future funding hurdles, and the picture gets grim. Time, that most finite resource, slips away with every distraction this model brings.

For startups eyeing this path, pause and weigh the trade-offs. Lump sums or milestone-based funding might offer the breathing room and freedom to thrive. Funding isn’t just about the dollars; it’s about the terms that can make or break your journey. Choose with your eyes wide open.

Content authored with the assistance of Gork AI & image generated using Chat.com

#StartupFunding #FounderAdvice #VentureCapital